March 12, 2015

UPDATE: New information from City Colleges of Chicago has been provided to the Civic Federation that makes adjustments to past years’ Statements of Net Position to comply with the Governmental Accounting Standards Board (GASB) Statements 54 and 63. It will be included in the FY2015 Comprehensive Annual Financial Report. The District’s Unrestricted Fund Balance in FY2010, FY2011, and FY2012 increases significantly as a result of the changes.

In this blog, the Civic Federation examines City Colleges of Chicago’s fund balance levels as reported in its recently released Comprehensive Annual Financial Report (CAFR) for the fiscal year ending June 30, 2014.

Fund balance is a term commonly used to describe the net assets of a governmental fund and serves as a measure of financial resources. The Federation previously blogged about changes made to reporting fund balance per the implementation of the Governmental Accounting Standards Board (GASB) Statement No. 54 which reclassifies fund balance components within the governmental funds. The City Colleges of Chicago, however, is not required to implement those changes because, as a public college system with primarily business-type activities, it does not have governmental funds. Instead, City Colleges reports net assets for its business-type funds.

The Government Finance Officers Association (GFOA) recommends that general purpose governments maintain an unrestricted general fund fund balance of no less than two months, or 16.7%, of regular general fund operating revenues or regular general fund operating expenditures. City Colleges is a special purpose, not a general purpose government, but its size and the relative instability of its revenue stream make it prudent for the District to maintain adequate reserves. The GFOA statement adds that each unit of government should adopt a formal policy that considers the unit’s own specific circumstances and that a smaller fund balance ratio may be appropriate for the largest governments. Since the fund balance ratio reflects the savings that a government has accumulated relative to its expenditures for the fiscal year, it is an indicator of the government’s financial ability to maintain current service levels. Data used to calculate the ratio is found in the Statement of Net Assets from the City Colleges audited financial report.

City Colleges Resolution Number 29253, adopted on February 5, 2009, recommends that unrestricted fund balance over 3% of the unrestricted funds actual expenses may be transferred to the Operations and Maintenance Fund subject to the Board’s approval. This effectively maintains a 3% minimum unrestricted funds fund balance.[1] The District included additional guidelines in its FY2015 budget that the District uses to manage its fund balances, including not using operating fund fund balance to finance current operations and recognizing bond ratings, credit implications and the District’s limited revenue sources as important factors to be considered before using fund balance.[2]

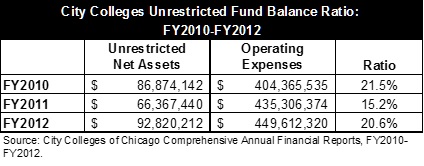

Between FY2010 and FY2012, City Colleges’ general operating funds’ unrestricted net assets decreased from 21.5% of operating expenses, or $86.9 million, to 20.6%, or $92.8 million. During this time period, FY2011 is the only year City Colleges dipped below the minimum two months of operating expenses recommended by the GFOA. The healthy level of net assets for City Colleges is a dramatic turnaround from the 1.1% fund balance ratio reported in FY2000.[3]

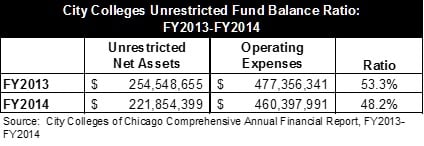

The following chart presents unrestricted fund balance for FY2013 and FY2014. In this exhibit, the District’s unrestricted net assets amount to $254.5 million, or 53.3% of operating expenditures in FY2013 and $221.9 million, or 48.2% in FY2014. The District reclassified its formerly restricted net position relating to capital projects and other to an unrestricted net position. City Colleges issued bonds in 1987 and 1988 and according to GASB Statement No. 54, the proceeds from the bonds should have been included in the unrestricted fund balance. Had the reclassification not taken place, the District’s audited Unrestricted Net Assets for FY2013 would have totaled $94.3 million, lowering the FY2013 fund balance ratio to 19.8%, a drop of 0.8 percentage points from FY2012 but still above GFOA recommended minimum levels.[4] The recalculated FY2014 fund balance would also be lower.

[1] See the resolution on the City Colleges of Chicago’s website at http://apps.ccc.edu/brpublic/2009/feb/29253.pdf.

[2] City Colleges of Chicago, FY2015 Tentative Annual Operating Budget, p. 36.

[3] In FY2000, the District recorded an unrestricted fund balance of $3.0 million and operating expenditures of $265.1 million, resulting in a fund balance ratio of 1.1%. See the City Colleges of Chicago FY2000 Financial Statements, p. 3.

[4] Communication with City Colleges of Chicago budget staff, June 30, 2014.